People will bring their prejudices to the table when judging whether Facebook agreeing to pay up to $19bn for messaging app WhatsApp is a smart deal or not.

Some will see it as the latest evidence of a froth-fuelled social networking and apps bubble, which won’t end well. Others will hail it as the bold, decisive move of a visionary CEO.

WhatsApp may be labeled as the next Myspace or Bebo: bought for big bucks then withering as its users drain away. But it may also be seen as the next YouTube – bought for what seems like a ridiculously high sum, only to thrive so well that price looks like a bargain a few years down the line.

As with any big technology story, people will fit Facebook’s WhatsApp acquisition neatly into whatever their existing narrative is for what’s happening around smartphones, social networking and big tech more generally.

Nevertheless, here are some facts and expert views to help you draw your own conclusions about the impact of the deal.

Multiple Facebook apps in your home screen

When the deal closes, Facebook will own four of the world’s most popular smartphone apps: Facebook itself, Instagram, WhatsApp and Facebook Messenger – the social network says it’s committed to maintaining the latter, although we’ll see if that holds true in the long term.

Facebook wants to be on your smartphone in multiple ways, taking up several slots on your homescreen rather than just one. This strategy had already been outlined before yesterday’s news, though.

“Our vision for Facebook is to create a set of products that help you share any kind of content you want within the audience you want. We’re not just focused on improving the experience of sharing with all of your friends at once,” CEO Mark Zuckerberg told analysts during Facebook’s last earnings call.

“One of the things that we want to try to do over the next few years is build a handful of great new experiences that are separate from what you think of as Facebook today.”

If the average person’s smartphone usage tilts towards using a group of apps that mostly do one thing well – messaging, photos, games, whatever – then Facebook wants to be providing as many of them as possible. And if it can’t build successful enough standalone apps, it will buy them.

Look beyond the dollar amount

The figures are startling: $4bn of cash, $12bn in Facebook shares and a further $3bn in stock that will vest over the next few years. Cue the obvious “How many X is WhatsApp worth?” calculations – 19 Instagrams, 76 Washington Posts, or 96bn extra moves in Candy Crush Saga – which might even be enough to get you past level 147.

It’s important to look beyond the pure dollar amount, though. The former mobile analyst Benedict Evans, who now works for venture capital firm Andreessen Horowitz, thinks it’s more useful to think about the impact on Facebook using other metrics.

“It paid first 1% of its market value for Instagram and now close to 10% for WhatsApp, taking not dominance but at the least two of the commanding heights of mobile social,” he wrote in a blog post after the news was announced.

“That’s the right way to think about value, I think - not ‘OMG $16bn!’, but ‘is this worth 10% of Facebook?’ The deal values WhatsApp users at $35 each (very close to what Google paid for YouTube, incidentally), but the current market cap of Facebook values its MAUs at $140 or so.”

The entrepreneur and investor Martin Varsavsky also addressed the valuation of WhatsApp in his own blog post.

“The WhatsApp acquisition price sounds high, sky high, crazy high. But it’s not if you put yourself in Zuckerberg’s shoes and think about it in these terms: Facebook bought a network that is growing much faster than itself (growth drives valuations) and has almost half as many members already, for 10% of its value,” he wrote.

“So from this perspective it is reasonable to pay that price. If you call WhatsApp a better SMS system, on size alone, it is as big as half of all the texting that goes on in the world. SMS as Facebook said in its investor conference after the acquisition is a $100bn industry although imploding fast to the tiny cost of WhatsApp, $1 a year.”

Forrester’s Julie Ask suggested that the deal is an example of pragmatism on both sides. “There are a dwindling number of privately held companies with audience numbers in the hundreds of millions. Tencent (WeChat) is public. Line belongs to Naver Corporation. Rakuten bought Viber last week,” she wrote. “Kudos to the founders for not snubbing a few billion dollars.”

No ads, maybe, but…

Facebook bought Instagram, waited, then introduced advertising. WhatsApp will go the same way, right? Actually, wrong, according to its CEO Jan Koum. “Here’s what will change for you, our users: nothing. WhatsApp will remain autonomous and operate independently,” he wrote yesterday.

“You can continue to enjoy the service for a nominal fee. You can continue to use WhatsApp no matter where in the world you are, or what smartphone you’re using. And you can still count on absolutely no ads interrupting your communication. There would have been no partnership between our two companies if we had to compromise on the core principles that will always define our company, our vision and our product.”

WhatsApp’s no ads policy has been consistent throughout its rapid growth to 450 million active users: its business model settled down as a $1 annual subscription after a year of free usage. Can that stance really survive once WhatsApp is part of Facebook?

Two points. First: WhatsApp has huge reach but it doesn’t really have enough data to be really interesting for advertisers in its current form. By design; it doesn’t collect names, ages, genders or addresses, and it doesn’t store users’ messages on its servers. Not a great ad-targeting platform compared to the way Facebook’s advertising business works.

Second, though: what WhatsApp does collect is people’s phone numbers. An alternative way of looking at the deal is as Facebook agreeing to pay up to $19bn for 450 million people’s phone numbers – more, if you consider registered users rather than active ones.

“Lot of info in a phone number. Tie it all back to everything else. Ick,” as one industry source told the Guardian. Will all those phone numbers help Facebook’s advertising business outside WhatsApp? That’s a question to ponder in the months ahead.

Facebook bought the simplest messaging app

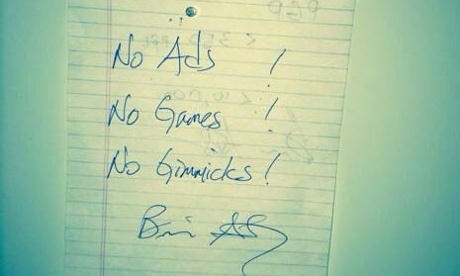

A Tumblr post by WhatsApp investor Jim Goetz, of VC firm Sequoia, includes a photograph of the note stored on Koum’s desk – a three-line statement of WhatsApp’s guiding principles written by his co-founder Brian Acton:

Most of WhatsApp’s rivals – from Line, Kakao and WeChat in Asia to Kik and BBM in the west – have been turning themselves into platforms for everything from gaming and music through to shopping and brand marketing. In a sense, they’re all trying to replace Facebook, in a sprawling, multipurpose sense.

WhatsApp is for messaging. No games, and no gimmicks. And it’s the app that a) got to 450 million active users, and is still adding 1 million a day in 2014, and b) got bought by Facebook for up to $19bn. Its single-minded simplicity is what made it worth so much in Facebook’s eyes.

Expect frenetic speculation about which messaging apps will get bought up next, by which tech giants for what purpose. Naturally, some of these companies will be eagerly fuelling the speculation.

“It’s $16bn clearer that we’re now in the age of the mobile messenger,”Kik’s CEO Ted Livingston told TechCrunch last night (referring to the initial cash-and-stock price Facebook is paying). “Having a popular mobile messenger is simply going to become table stakes for competing in the mobile era.”

There will be consolidation – of course there will – but it’s less about “company X is now worth Y because WhatsApp was worth Z” and more about what specific messaging apps are worth to specific buyers. Simplicity sealed the deal for Facebook, but will the mini-Facebook platform strategy tempt others?

“From an industry perspective, it is likely that further consolidation will occur, though it’s unlikely that subsequent acquisitions will provide as high a return as that achieved by WhatsApp,” said the Informa Telecoms & Media analyst Pamela Clark-Dickson today.

Meanwhile, Forrester analyst Nate Elliott has warned against seeing the deal as Facebook chasing teenage users who may have drifted away from the social network. “It’ll be tempting to read this as a sign Facebook is scared of losing teens. And yes, the company does have to work hard to keep young users engaged,” said Elliott.

“But the reality is, Facebook always works hard to keep all its users engaged, no matter their age. Facebook is tireless in its efforts to keep users coming back. That’s why their 1.2 billion monthly users keep visiting the site more and more frequently, rather than drifting away.”

Hello operators

Zuckerberg’s next public appearance is a keynote speech at the Mobile World Congress conference in Barcelona later this month: an event still dominated by the global mobile operators.

Imagine if Zuckerberg had saved the WhatsApp news for a one-more-thing moment towards the end of his speech. “Facebook is a strong partner for carriers, not their enemy. We complement their business, not cannibalise it. Oh, by the way, we’re buying WhatsApp …”

It’s difficult to avoid viewing the acquisition through the prism of what it means for the wider telecoms industry, at a time when WhatsApp and its rivals have already done a good job of surpassing the volume of SMS text messaging. It’s not so long since the prospect of a “Facebook Phone” was seen as a threat to operators. Now think about Facebook owning phone messaging.

“Mobile operators are in an interesting position: Facebook, one of their key content partners, now owns an application that has been a major catalyst in the decline of SMS revenues and, for some, SMS traffic,” said Clark-Dickson.

Varsavsky thinks the social network has more ambitious plans than that. “Where are Facebook/WhatsApp headed? In my view to do with telephone minutes what WhatsApp already did with SMS,” he wrote.

“It is surprising that Facebook which wants to connect everyone on the planet still does not have a platform to people to have actual conversations a la Viber or Skype. I can’t imagine that things will stay this way. And owning world’s texting and world’s conversations may very well be worth $19bn.”

Evans takes a different view, highlighting the stats comparing mobile messaging apps’ growth to SMS texting volumes, while suggesting that the potential of something like WhatsApp lies beyond pure communication.

“Mobile social apps are not, really, about free SMS. Mobile discovery and acquisition is a mess – it’s in a ‘pre-pagerank’ phase where we lack the right tools and paths to find and discover content and services efficiently,” he wrote.

“Social apps may well be a major part of this, as I discussed in detailhere. These apps have the opportunity to be a third channel in parallel to Google and Facebook.”

Police have launched an investigation after graffiti was found throughout the school's campus to remember the "fall of sexual violence at Inha University." 파워볼게임

RépondreSupprimer